StopWaste Grant Program Insurance Requirements

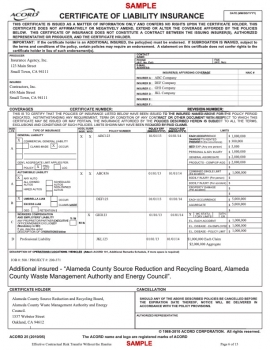

It is a requirement of StopWaste that any business or organization selected to receive grant funding maintain the following minimum insurance during the term of the Grant contract. As part of the application, grant applicant shall submit to StopWaste certificates of insurance for the policies listed below.

- REQUIRED: Comprehensive general liability insurance, including personal injury liability, blanket contractual liability, and broad-form property damage liability coverage. The combined single limit for bodily injury and property damage shall be not less than $1 million, though $2 million is preferred. $2 million is required for grants that expose StopWaste to liability.

- If proposed projects involve driving: REQUIRED: Automobile bodily injury and property damage liability insurance covering owned, non-owned, rented, and hired cars is ANY driving is being done related to the grant. The combined single limit for bodily injury and property damage shall be not less than $1,000,000.

- If organization maintains paid employees (Contractors are not considered employees) REQUIRED: Statutory workers' compensation and employer's liability insurance as required by state law.

If applicant does not currently maintain insurance that meets the Agency’s requirements, a submittal of a current insurance quote that meets these requirements will suffice for application purposes only. Any applicant selected for grant funding must procure insurance that meets the above requirements in order to enter into a funding agreement with StopWaste. Cost to purchase or bring insurance coverage up to required minimums can be included as part of proposed grant budget, in which case they should be included in project budget as a line item.

Under special circumstances, exceptions may be made to the minimum insurance requirements, but only upon prior agreement by StopWaste.

Insurance FAQ’s

Auto Insurance

1. If employees are driving for a grant project, does the applicant require auto insurance that covers their employees?

Yes.

2. If applicants do not have employees that drive for their work activities, and applicants do not own vehicles, is auto insurance required?

No.

3. If an organization depends on volunteers to collect/deliver recovered goods in their personal auto, does the volunteer’s personal auto insurance suffice?

Yes.

4. Does StopWaste (Alameda County Waste Management Authority) need to be named as additional insured on auto insurance policy?

No.

5. If an organization is considering giving their volunteer driver a monthly honorarium or possibly paying them as an independent contractor (1099) would that count as paid employee, meaning they would need additional auto insurance for the org as opposed to the driver’s personal insurance?

Grant applicant should confirm that volunteer/contractor has personal auto insurance. Applicants are not required to maintain auto insurance with coverage for volunteers or contractors for this grant application process.

Workers Comp - Employees/Contractors/Volunteers

1. If I have employees, do I need to provide Workers Comp Insurance? What if I only have one employee?

Yes. Statutory workers' compensation and employer's liability insurance as required by state law with a limit of at least $1,000,000 per accident for bodily injury or disease.

2. Are volunteers considered employees and would I need to provide workers comp?

No.

3. If I have contractors, do I need to provide workers comp?

Your contractors should be covered under your general liability insurance. It is up to you (contractor/grantee) to verify this on your policy prior to being awarded any funds.

4. Does StopWaste (Alameda County Waste Management Authority) need to be named as additional insured on workers comp policy?

No. Only proof of W/C with proper coverage needs to be provided.